will long term capital gains tax change in 2021

The 50 of the capital gain that is taxable less any offsetting capital losses gets added to your income and is taxed at your marginal tax rate based on your level of income and province of residence as of December 31. May 11 2021 800 AM EDT.

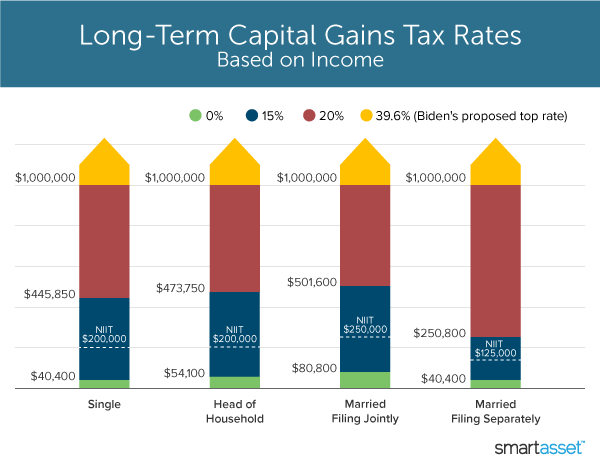

What S In Biden S Capital Gains Tax Plan Smartasset

One crucial change for the tax year 2021 and beyond is that you can claim the EITC as long as your investment income does not exceed 10000.

. 22 of the last 30276. President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate the elimination of the stepped-up basis on. By Marc Frye Nov 18 2021.

The federal tax rates for 2021 can be found on the Canada Revenue Agency CRA website. A long-term capital loss you carry over to the next tax year will reduce that years long-term capital gains before it reduces that years short-term capital gains. Long-Term Care Basics.

Remember if you have short-term capital gains they are taxed at the ordinary income tax rates. As a business seller if you are in either the low or mid earning bracket any proposed changes will not affect you so proceed with the sale of your business. Hawaiis capital gains tax rate is 725.

In other words if your long-term capital gains bring your taxable income 1. Increase in the Long-term Capital Gains Tax Rate. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396.

0 15 and 20. Remember this isnt for the tax return you file in 2022 but rather any gains you incur from January 1 2022 to December 31 2022. The actual rates didnt change for 2020 but the income brackets did adjust slightly.

12 of the next 31499 of income. Long-term gains still get taxed at rates of 0 15 or 20 depending on the. If your long-term capital gains take you into a higher tax bracket only the gains above that threshold will be taxed at the higher rate.

The donor receives an income stream from the trust for a term of years or for life and the named. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. Long-term capital gains are taxed at only three rates.

These taxpayers would have to pay a tax rate. For long-term capital gains you fall into the 15 tax bracket so you calculate your long-term capital gains tax as 15. The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20.

Ad If youre one of the millions of Americans who invested in stocks. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change. That applies to both long- and short-term.

4 rows Additionally the proposal would impose a 3 surtax on modified adjusted gross income over. Here are the 2021 long-term capital gains tax rates. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to that for ordinary.

Long-term capital gains are incurred on appreciated assets sold after more than one year. Or sold a home this past year you might be wondering how to avoid tax on capital gains. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term.

Changes to Capital Gains Tax 2021. As the tables above show many taxpayers are eligible to have their long-term capital gains. This tax increase applies to high-income individuals with an AGI of more than 1 million.

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

There S A Growing Interest In Wealth Taxes On The Super Rich

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

All About Capital Gains Tax How To Calculate Income From Capital Gains Indexation Concept Youtube

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Understanding Taxes And Your Investments

Exemption From Capital Gains On Debt Funds Paisabazaar Com

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022

Capital Gains Tax In Canada Explained

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)